Part of V&S Group

-

TRADING

TRADING PLATFORM

Account type

Margin requirements

- TRADE RESOURCES

- INSTITUTIONAL SERVICE

- ABOUT

One thing to remember is that in order to purchase stocks from a particular country, you must first have the local currency. To invest in stocks in the Japan, a European investor must first exchange his euros (EUR) into Japanese yen (JPY).

This increased demand for JPY causes the value of the JPY to appreciate. On the other hand, selling euros increases its supply, which drives the euro’s value lower. When the outlook for a certain stock market is looking good, international money flows in.

On the other hand, when the stock market is struggling, international investors take their money out and look for a better place to park their funds. Even though you may not trade stocks, as a forex trader, you should still pay attention to the stock markets in major countries. If the stock market in one country starts performing better than the stock market in another country, you should be aware that money will probably be moving from the country with the weaker stock market to the country with the stronger stock market. This could lead to a rise in value of the currency for the country with the stronger stock market, while the value of the currency could depreciate for the country with the weaker stock market:

1. Strong stock market = strong currency.

2. Weak stock market = weak currency.

|

INDEX |

DESCRIPTION |

|

Dow |

The Dow

Jones Industrial Average (or Dow for short), is considered to be one of the

premier stock indexes in the U.S. It measures how well the top 30 publicly

owned companies are trading. |

|

S&P500 |

The Standard & Poor 500, more

commonly known as the S&P 500, is a weighted index of the stock prices of

the 500 largest American companies. |

|

NASDAQ |

NASDAQ

stands for National Association of Securities Dealers Automated Quotations. |

|

Nikkei |

The Nikkei, similar to the Dow Jones Industrial Average, is the most widely quoted average of the Japanese stock market. |

|

It is a price-weighted average of the top 225 companies and is supposed to be reflective of the overall market.The Nikkei includes companies like Toyota, Japan Airlines, and Fuji film. |

|

|

Dax |

The DAX

is short for the Deutscher Aktien Index (you’re probably better off

remembering just DAX). It is the stock market index in Germany that consists

of the top 30 blue chip companies that are traded on the Frankfurt Stock

Exchange. |

|

DJ EURO STOXX 50 |

The Dow Jones Euro Stoxx 50 index is the euro zone’s leading blue-chip index. It comprises over 50 top-sector stocks from 12 euro zone countries. It was created by Stoxx Ltd., which is a joint venture of Deutsche Boerse AG, Dow Jones & Company and SIX Swiss Exchange. |

|

FTSE |

The FTSE (pronounced “footsie”) index tracks the performance of the most highly capitalized UK companies listed on the London Stock Exchange. There are several versions of this index, such as the FTSE 100 or FTSE 250, depending on the number of companies included in the index. |

|

Hang Seng |

The Hang Seng index is a stock market index in Hong Kong. By recording and monitoring the daily price changes of the stocks included in the index, it tracks the overall performance of the Hong Kong stock market. This index is currently compiled by the HSI Services Limited, which is a subsidiary of Hang Seng Bank. |

Now lets us discuss how these stocks affect the Forex market and currencies. If you see a rally in the stock market of US with Dow Jones, S&P 500 or NASDAQ rallying and gaining new highs, the foreign investors will likely to put their money in the stocks of this country because they also want to enjoy the fruits that this market is currently giving. In order to do so they will have to buy US dollars first to buy the stocks, which means they will sell their domestic currency in order to buy the US dollar which will cause the US dollar to rise. Similarly, the country which faces a downfall in the stocks market will see their currency going down because now the foreign investors are drawing their money out and selling off the stocks and reconverting the US dollars into their domestic currency or some other form of investment.

Now if you know that this country’s stocks are going up then you can buy that currency because that currency is getting stronger now and will rise. Similarly, a country whose stock market is facing a decline you can sell that country’s currency because now that currency is getting weaker and will likely fall down.

Relationship between stocks and Forex is not this simple. Their correlation may change from time to time depending on the global financial condition. Like way before financial crises of 2007 Nikkei and USDJPY were inversely correlated but soon after that they become positively correlated. Nikkei and USDJPY have shown a strong correlation. Sometimes they are uncorrelated but that is only for a short period of time then they get together again. So, any news that can affect Nikkei will possibly affect USDJPY too so keeping an eye on it will help you in getting an opportunity to go long or short. Below is a chart showing correlation between USDJPY and Nikkei.

There can be correlations between stock markets and certain currencies or pairs in the forex market. Lets take a look at the Nikkei and the USD/JPY pair as an example. Originally it was assumed that Nikkei stock market was a good reflection on the strength of the country.

So if the Nikkei stock market were to rally then this would lead to the yen strengthening and the USD/JPY dropping. Likewise, if the Nikkei were to drop then the USD/JPY price would rise due to a weakening yen.

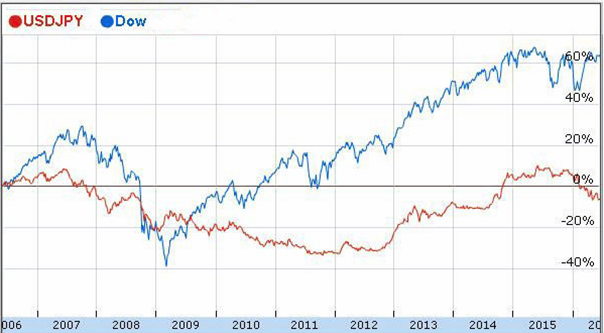

Since the 2007 financial crisis the correlation between Nikkei and USD/JPY has moved in the same direction as can be seen in the chart below.

Let’s take a look at the correlation between the USD/JPY and the Dow.

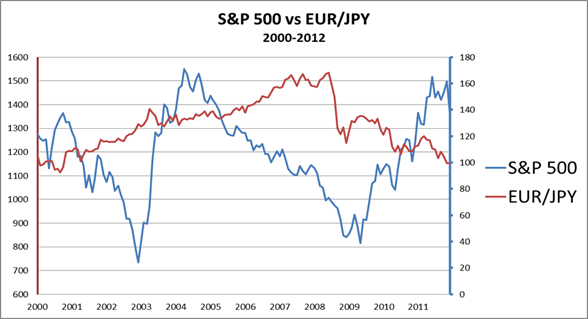

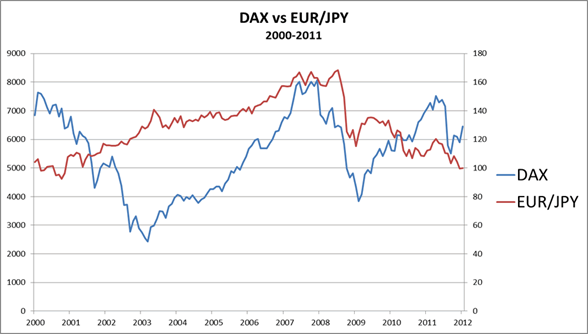

As we said earlier, in order for someone to invest in a particular stock market, one would need the local currency in order to purchase stocks. You can imagine what the effect of stock markets like the DAX (that’s the German stock market), have on currencies.

In theory, whenever the DAX rises, we can probably expect the euro to rise as well, as investors need to get a hand on some euros. While the correlation is imperfect, statistics show that it still holds pretty accurately.

The correlation seems to have held well this past decade, as EUR/JPY and both indexes rose steadily together, until 2008, when we were hit with the Great Financial Crisis (GFC).

|

IF |

THEN |

WHY |

|

Gold ↑ |

USD ↓ |

During times of economic unrest, investors tend to dump the dollar for gold. Unlike other assets, gold maintains its value. |

|

Gold ↑ |

AUD/USD ↑ |

Australia is the third biggest gold producer in the world, sailing out about $5 billion worth a year. |

|

Gold ↑ |

NZD/USD ↓ |

New Zealand (rank 25) is also a large producer of gold. |

|

Gold ↑ |

USD/CHF ↓ |

Over 25% of Switzerland’s reserves are backed by gold. As gold prices go up, the pair moves down (CHF is bought). |

|

Gold ↑ |

USD/CAD ↓ |

Canada is the 5th largest producer of gold in the world. As gold price goes up, the pair tends to move down (CAD is bought). |

|

Oil ↑ |

USD/CAD ↓ |

Canada is one of the top oil producers in the world. It exports around 2 million barrels of oil a day to the U.S. As oil prices go up, the pair moves down. |

|

Gold ↑ |

EUR/USD ↓ |

Since both gold and euro are considered “anti-dollars,” if the price of gold goes up, EUR/USD may go up as well. |

|

Bond yields ↑ |

Local Currency ↓ |

An economy that offers higher returns on its bonds attract more investments. This makes its local currency more attractive than that of another economy offering lower returns on its bonds. |

|

Dow ↓ |

Nikkei ↓ |

The performance of the U.S. economy is closely tied with Japan. |

|

Nikkei ↓ |

USD/JPY ↓ |

Investors consider the yen as a safe-haven and tend to seek it during periods of economic distress. |

*The information presented above is intended for informative and educational purposes, should not be considered as investment advice, or an offer or solicitation for a transaction in any financial instrument and thus should not be treated as such. Past performance is not a reliable indicator of future results.

Cairo Investment Expo 2021

Ultimate FinTech Awards 2022

European Fintech 2022

2023 Global Forex Awards

Cairo Investment Expo 2021

Ultimate FinTech Awards 2022

European Fintech 2022

2023 Global Forex Awards

Online Chat Chat with us

Email:supportsohomarkets.com

Copyright © 2024 - All rights reserved.

Soho Markets LLC is incorporated in St. Vincent & the Grenadines as an International Business Company with registration number 1310 LLC 2021.

Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Please read the full Risk Disclosure.

Regional Restrictions: SOHO MARKETS GLOBAL LIMITED does not provide services in the territories of the United States of America, Canada, Israel, Japan, North Korea, Belgium, and UN/EU Sanctioned countries.

Soho Markets Global Limited and Soho Markets LLC do not provide services to EU clients. EU clients can only be serviced by Vstar & Soho Markets Ltd.

CLIENT AGREEMENT (TERMS AND CONDITIONS) Privacy Policy Risk Disclosure