Part of V&S Group

-

TRADING

TRADING PLATFORM

Account type

Margin requirements

- TRADE RESOURCES

- INSTITUTIONAL SERVICE

- ABOUT

Yes, it is true that the forex market is open 24 hours a day, but that doesn’t mean it’s always active the entire day. You can make money trading when the market moves up, and you can even make money when the market moves down. BUT you will have a very difficult time trying to make money when the market doesn’t move at all.

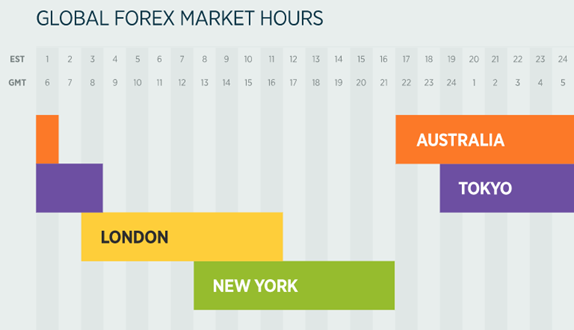

Before looking at the best times to trade, we must look at what a 24-hour day in the forex world looks like. The forex market can be broken up into four major trading sessions: the Sydney session, the Tokyo session, the London session and the New York session.

Below are tables of the open and close times for each session:

Spring/Summer in the U.S. (March/April – October/November)

|

LOCAL TIME |

EDT |

BST (GMT+1) |

|

Sydney Open – 7:00 AM |

5:00 PM |

10:00 PM |

|

Sydney Close – 4:00 PM |

2:00 AM |

7:00 AM |

|

Tokyo Open – 9:00 AM |

8:00 PM |

1:00 AM |

|

Tokyo Close – 6:00 PM |

5:00 AM |

10:00 AM |

|

London Open – 8:00 AM |

3:00 AM |

8:00 AM |

|

London Close – 4:00 PM |

11:00 AM |

4:00 PM |

|

New York Open – 8:00 AM |

8:00 AM |

1:00 PM |

|

New York Close – 5:00 PM |

5:00 PM |

10:00 PM |

Fall/Winter in the U.S. (October/November – March/April)

|

LOCAL TIME |

EST |

GMT |

|

Sydney Open – 7:00 AM |

3:00 PM |

8:00 PM |

|

Sydney Close – 4:00 PM |

12:00 AM |

5:00 AM |

|

Tokyo Open – 9:00 AM |

7:00 PM |

12:00 AM |

|

Tokyo Close – 6:00 PM |

4:00 AM |

9:00 AM |

|

London Open – 8:00 AM |

3:00 AM |

8:00 AM |

|

London Close – 4:00 PM |

11:00 AM |

4:00 PM |

|

New York Open – 8:00 AM |

8:00 AM |

1:00 PM |

|

New York Close – 5:00 PM |

5:00 PM |

10:00 PM |

Open and close times will also vary during the months of October/November and March/April as some countries (like the United States, England and Australia) shift to/from daylight savings time (DST). This website will help https://forex.timezoneconverter.com/

Also take notice that in between each forex trading session, there is a period of time where two sessions are open at the same time. During the summer, from 3:00-4:00 AM ET, for example, the Tokyo session and London session overlap, and during both summer and winter from 8:00 AM-12:00 PM ET, the London session and the New York session overlap.

Naturally, these are the busiest times during the trading day because there is more volume when two markets are open at the same time. Now let’s take a look at the average pip movement of the major currency pairs during each forex trading session.

|

PAIR |

TOKYO |

LONDON |

NEW YORK |

|

EUR/USD |

76 |

114 |

92 |

|

GBP/USD |

92 |

127 |

99 |

|

USD/JPY |

51 |

66 |

59 |

|

AUD/USD |

77 |

83 |

81 |

|

NZD/USD |

62 |

72 |

70 |

|

USD/CAD |

57 |

96 |

96 |

|

USD/CHF |

67 |

102 |

83 |

|

EUR/JPY |

102 |

129 |

107 |

|

GBP/JPY |

118 |

151 |

132 |

|

AUD/JPY |

98 |

107 |

103 |

|

EUR/GBP |

78 |

61 |

47 |

|

EUR/CHF |

79 |

109 |

84 |

From the table, you will see that the London session normally provides the most movement.

The forex market is a global exchange of currencies and currency-backed financial instruments (contracts to buy or sell currencies at a later date). Participants include everyone from the largest banks and financial institutions to individual investors. Currencies are traded directly for other currencies in the market. As a result, currencies are priced in terms of other currencies, like Euros per US Dollar or Japanese Yen per British Pound Sterling. By effectively seeking price differences and expected increases or decreases in value, participants can earn (sometimes large) returns on investment by trading currencies.

In the forex market, prices are quoted in terms of other currencies. This is because there is no measure of value that is not another currency. However, the US Dollar is used as a base currency for determining the values of other currencies.

For example, the price of the USD (EUR) is quoted as (price quote number) GBP/USD.

Currency quotes are listed to four decimal places.

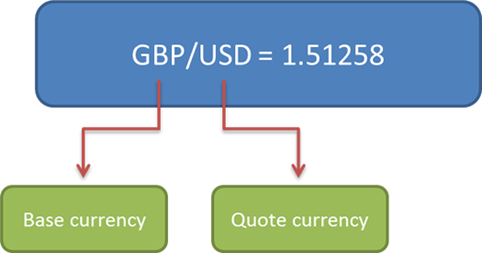

Currency quotes are simple to understand once you know how. For example, the British pound to US would be quoted as 1.51258 GBP/USD. You should understand this as "you need to spend 1.51258 US Dollars to buy one British pound."

The first listed currency to the left of the slash (“/”) is known as the base currency (in this example, the British pound), while the second one on the right is called the counter or quote currency (in this example, the U.S. dollar).

When buying, the exchange rate tells you how much you have to pay in units of the quote currency to buy one unit of the base currency. When selling, the exchange rate tells you how many units of the quote currency you get for selling one unit of the base currency.

In the example above, you will receive 1.51258 U.S. dollars when you sell 1 British pound.

The base currency is the “basis” for the buy or the sell. If you buy EUR/USD this simply means that you are buying the base currency and simultaneously selling the quote currency.

1. You would buy the pair if you believe the base currency will appreciate (gain value) relative to the quote currency.

2. You would sell the pair if you think the base currency will depreciate (lose value) relative to the quote currency.

In the following examples, we are going to use fundamental analysis to help us decide whether to buy or sell a specific currency pair.

When we buy a currency pair, it means

that we are buying the Base Currency by selling the Quote Currency. Buying

EUR/USD means that we are buying euro by selling USD. When we sell a

currency pair, it means that we are selling the Base Currency by buying the

Quote Currency. Selling EUR/USD means that we are selling the euros to buy

USD.

The ‘basis’ for the buy or sell is the base currency, in our case the EUR. The

traveler first sold the EUR/USD pair – to do this he paid (i.e. sold) the base

currency (euros) to get (i.e. to buy) equivalent dollars. In the second

transaction, he bought the EUR/USD pair – to do this he bought his euros back

by paying (i.e. selling) the quote currency i.e. dollars.

Therefore, buying a currency pair just means that we are buying the Base Currency by paying by or selling the quote currency and Selling a currency pair means that we are paying by (or selling) the base currency to buy the quote currency. The first currency in the currency pair is the Base currency - just for the ready reference.

The value of currencies appreciate or depreciate against other currencies because of the gaps in demand and supply. From longer-term perspective the demand and supply depends on the health of the economy. If the economy of a country A is doing better than the economy of country B, then the currency of country A will be more in demand and it's price will go up. Here the fundamental analysis comes into picture.

In the shorter-term, the prices move because of short-term speculative trading. Here the technical analysis comes into the picture. You can BUY the currency pair if you think the base currency will APPRECIATE compared to the quote currency. Similarly, we can SELL the pair if you think that the base currency will DEPRECIATE compared to the quote currency.

In Forex market you can but a currency pair when you analyze that the price of the base currency should go up. When the price appreciate, you can sell the currency pair to earn your profits.

On the other hand, if your analysis says that the price of the base currency should go down, then you sell the pair first (yes, you do not own it as yet) and when the price go down. then you buy it back to cover your already sold position to earn your profits. When you had sold it without having it, you had just taken it on loan or borrowing from your Forex broker and had sold that. And when the price went down, you buy the currency pair to close your trading position.

You ‘take a position’ in the Forex market when you buy or short-sell a pair.

Margin trading is a method of trading assets using funds provided by a third party. When compared to regular trading accounts, margin accounts allow traders to access greater sums of capital, allowing them to leverage their positions. Essentially, margin trading amplifies trading results so that traders are able to realize larger profits on successful trades. This ability to expand trading results makes margin trading especially popular in low-volatility markets, particularly the international Forex market. Still, margin trading is also used in stock, commodity, and cryptocurrency markets.

In traditional markets, the borrowed funds are usually provided by an investment broker. In cryptocurrency trading, however, funds are often provided by other traders, who earn interest based on market demand for margin funds. Although less common, some cryptocurrency exchanges also provide margin funds to their users.

When a margin trade is initiated, the trader will be required to commit a percentage of the total order value. This initial investment is known as the margin, and it is closely related to the concept of leverage. In other words, margin trading accounts are used to create leveraged trading, and the leverage describes the ratio of borrowed funds to the margin. For example, to open a $100,000 trade at a leverage of 10:1, a trader would need to commit $10,000 of their capital.

Naturally, different trading platforms and markets offer a distinct set of rules and leverage rates. In the stock market, for example, 2:1 is a typical ratio, while futures contracts are often traded at a 15:1 leverage. In regards to Forex brokerages, margin trades are frequently leveraged at a 50:1 ratio, but 100:1 and 200:1 are also used in some cases.

Margin trading can be used to open both long and short positions. A long position reflects an assumption that the price of the asset will go up, while a short position reflects the opposite. While the margin position is open, the trader’s assets act as collateral for the borrowed funds. This is critical for traders to understand, as most brokerages reserve the right to force the sale of these assets in case the market moves against their position (above or below a certain threshold).

For instance, if a trader opens a long leveraged position, they could be margin called when the price drops significantly. A margin call occurs when a trader is required to deposit more funds into their margin account in order to reach the minimum margin trading requirements. If the trader fails to do so, their holdings are automatically liquidated to cover their losses. Typically, this occurs when the total value of all of the equities in a margin account, also known as the liquidation margin, drops below the total margin requirements of that particular exchange or broker.

In the forex (FX) market, rollover is the process of extending the settlement date of an open position. In most currency trades, a trader is required to take delivery of the currency two days after the transaction date. However, by rolling over the position – simultaneously closing the existing position at the daily close rate and re-entering at the new opening rate the next trading day – the trader artificially extends the settlement period by one day.

Often referred to as tomorrow next, rollover is useful in FX because many traders have no intention of taking delivery of the currency they buy; rather, they want to profit from changes in the exchange rates. Since every forex trade involves borrowing one country's currency to buy another, receiving and paying interest is a regular occurrence. At the close of every trading day, a trader who took a long position in a high-yielding currency relative to the currency that they borrowed will receive an amount of interest in their account.

Conversely, a trader will need to pay interest if the currency they borrowed has a higher interest rate relative to the currency that they purchased. Traders who do not want to collect or pay interest should close out of their positions by 5 P.M. Eastern.

Note that interest received or paid by a currency trader in the course of these forex trades is regarded by the IRS as ordinary interest income or expense. For tax purposes, the currency trader should keep track of interest received or paid, separate from regular trading gains and losses.

*The information presented above is intended for informative and educational purposes, should not be considered as investment advice, or an offer or solicitation for a transaction in any financial instrument and thus should not be treated as such. Past performance is not a reliable indicator of future results.

Cairo Investment Expo 2021

Ultimate FinTech Awards 2022

European Fintech 2022

2023 Global Forex Awards

Cairo Investment Expo 2021

Ultimate FinTech Awards 2022

European Fintech 2022

2023 Global Forex Awards

Online Chat Chat with us

Email:supportsohomarkets.com

Copyright © 2024 - All rights reserved.

Soho Markets LLC is incorporated in St. Vincent & the Grenadines as an International Business Company with registration number 1310 LLC 2021.

Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Please read the full Risk Disclosure.

Regional Restrictions: SOHO MARKETS GLOBAL LIMITED does not provide services in the territories of the United States of America, Canada, Israel, Japan, North Korea, Belgium, and UN/EU Sanctioned countries.

Soho Markets Global Limited and Soho Markets LLC do not provide services to EU clients. EU clients can only be serviced by Vstar & Soho Markets Ltd.

CLIENT AGREEMENT (TERMS AND CONDITIONS) Privacy Policy Risk Disclosure