First, you should determine whether you want to buy or sell.

If you want to buy (which actually means buy the base currency and sell the quote currency), you want the base currency to rise in value and then you would sell it back at a higher price.

In trader’s talk, this is called “going long” or taking a “long position.” Just remember: long = buy.

If you want to sell (which actually means sell the base currency and buy the quote currency), you want the base currency to fall in value and then you would buy it back at a lower price.

This is called “going short” or taking a “short position”. Just remember: short = sell.

A bid-ask spread is the amount by which the ask price exceeds the bid price for an asset in the market. The bid-ask spread is essentially the difference between the highest price that a buyer is willing to pay for an asset and the lowest price that a seller is willing to accept. An individual looking to sell will receive the bid price while one looking to buy will pay the ask price.

A securities price is the market's perception of its value at any given point in time and is unique. To understand why there is a "bid" and an "ask" one must factor in the two major players in any market transaction, namely the price taker (trader) and the market maker (counterparty).

The market maker, usually financial brokerages, spreads (bid - price - ask) the price for the security that the price taker transacts at. The spread is the transaction cost. Price takers buy at the ask price and sell at the bid price but the market maker buys at the bid price and sells at the ask price. For the market maker the buy low - sell high paradigm for turning a profit is satisfied. This is what financial brokerages mean when they state that their revenues are derived from traders "crossing the spread."

The bid-ask spread is a reflection of the supply and demand for a particular asset. The bid represents demand and the ask represents supply for an asset. The depth of the "bids" and the "asks" can have a significant impact on the bid-ask spread, making it widen significantly if one outweighs the other or if both are not robust. Market makers and traders make money by exploiting the bid-ask spread and the depth of bids and asks to net the spread difference.

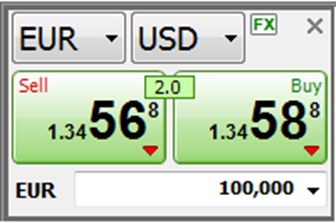

On the EUR/USD quote above, the bid price is 1.34568 and the ask price is 1.34588. Look at how this broker makes it so easy for you to trade away your money.

· If you want to sell EUR, you click “Sell” and you will sell euros at 1.34568.

· If you want to buy EUR, you click “Buy” and you will buy euros at 1.34588.

Here’s an illustration that puts together everything we’ve covered in this lesson:

A pip, short for point in percentage, is a very small measure of change in a currency pair in the forex market. It can be measured in terms of the quote or in terms of the underlying currency. A pip is a standardized unit and is the smallest amount by which a currency quote can change. It is usually $0.0001 for U.S.-dollar related currency pairs, which is more commonly referred to as 1/100th of 1%, or one basis point. This standardized size helps to protect investors from huge losses. For example, if a pip was 10 basis points, a one-pip change would cause greater volatility in currency values.

Assume that we have a USD/EUR direct quote of 0.7747. What this quote means is that for US$1, you can buy about 0.7747 euros. If there was a one-pip increase in this quote (to 0.7748), the value of the U.S. dollar would rise relative to the euro, as US$1 would allow you to buy slightly more euros.

The effect that a one-pip change has on the dollar amount, or pip value, depends on the amount of euros purchased. If an investor buys 10,000 euros with U.S. dollars, the price paid will be US$12,908.22 ([1/0.7747] x 10,000). If the exchange rate for this pair experiences a one-pip increase, the price paid would be $12,906.56 ([1/0.7748] x 10,000). In that case, the pip value on a lot of 10,000 euros will be US$1.66 ($12,908.22 - $12,906.56). If, on the other hand, the same investor purchases 100,000 euros at the same initial price, the pip value will be US$16.6. As this example demonstrates, the pip value increases depending on the amount of the underlying currency (in this case euros) that is purchased.

In forex trading, pip value can be a confusing topic. A pip is a unit of measurement for currency movement and is the fourth decimal place in most currency pairs. For example, if the EUR/USD moves from 1.1015 to 1.1016, that's a one pip movement. Most brokers provide fractional pip pricing, so you'll also see a fifth decimal place such as 1.10165, where the five represents a half pip.

How much of a profit or loss a pip of movement produces depends on the currency pair you are trading, and the currency you opened your account with. Pip value matters because it affects risk. If you don't know what the pip value is, you can't precisely calculate the ideal forex position size for a trade, and you may end up risking too much or too little on a trade.

The most heavily traded currency pairs in the world involve the U.S. dollar (USD). When the USD is listed second in a pair the pip value is fixed and doesn't change, assuming you have a USD dollar account.

The fixed pip amount is:

These pip values apply to any pair where the USD is listed second, such as the EUR/USD, GBP/USD, AUD/USD, NZD/USD

If the USD isn't listed second:

For example, to get the pip value of a standard lot for the USD/CAD, when trading a USD account, divide $10 by the USD/CAD rate. If the USD/CAD rate is 1.2500 the standard lot pip value in USD is $8, or $10 divided by 1.25. Whatever currency the account is, when that currency is listed second in a pair the pip values are fixed.

For example, if you have a Canadian dollar (CAD) account, any pair that is XXX/CAD, such as the USD/CAD will have a fixed pip value. A standard lot is CAD$10, a mini lot is CAD$1, and a micro lot is CAD$0.10.

To find the value of a pip when the CAD is listed first, divide the fixed pip rate by the exchange rate. For example, to find the value of a mini lot, if the CAD/CHF exchange rate is 0.7820, a pip is worth CAD$1.27.

If the pair includes the JPY, for example the JPY/CAD, then multiply the result by 10. For example, if the CAD/JPY is priced at 89.09, to find out the standard pip value divide CAD$10 by 89.09, then multiply the result by 10, for a pip value of CAD$11.23.

Go through this process with any account currency to find pip values for pairs that include that currency.

Not all currency pairs include your account currency. You may have a USD account, but want to trade the EUR/GBP. Here's how to figure out the pip value for pairs that don't include your account currency.

The second currency is always fixed if a person had an account in that currency. For example, we know that if a person held a GBP account then the EUR/GBP pip value is GBP10 for a standard lot, as discussed above. The next step is converting GBP10 to our own currency. If our account is USD, divide GBP10 by the USD/GBP rate. If the rate is 0.7600, then the pip value is USD$13.16.

If you can only find a "backward" quote, such as the GBP/USD rate being 1.3152, then divide one by the rate to get 0.7600. That is the USD/GBP rate. You can then do the calculation above.

If your account currency is euros and you want to know the pip value of the AUD/CAD, remember that for a person with a CAD account a standard lot would be CAD$10 for this pair. Convert that CAD$10 to euros by dividing it by the EUR/CAD rate. If the rate is 1.4813, the standard lot pip value is EUR6.75.

Always consider which currency is providing the pip value: the second currency (YYY). Once you know that, convert the fixed pip value in that currency to your own by dividing it by XXX/YYY, where XXX is your own account currency.

Understanding how pip values work is important, but if you want some help, there are several Pip Value Calculators online. Play around in a demo account and notice how pip movements affect your profit and loss for various pairs and lot sizes.

*The information presented above is intended for informative and educational purposes, should not be considered as investment advice, or an offer or solicitation for a transaction in any financial instrument and thus should not be treated as such. Past performance is not a reliable indicator of future results.

2021开罗投资博览会

2022年终极金融科技奖

2022欧洲金融科技

2023全球外汇奖

版权所有 © 2024

Soho Markets LLC在圣文森特和格林纳丁斯注册为国际商业公司(International Business Company),注册号为1310 LLC 2021

风险提示:差价合约(CFDs)是复杂的工具,由于杠杆作用带来亏损的风险很高。请您考虑是否了解差价合约(CFDs)的工作原理,以及是否有能力承担资金亏损的高风险。请阅读完整的风险披露

区域限制:SOHO MARKETS GLOBAL LIMITED不为美国、加拿大、以色列、日本、朝鲜、比利时和联合国/欧盟制裁国家提供服务