Parte do Grupo V&S

-

Negociação

Plataforma de negociação

tipo de conta

Requisitos de margem

- Recursos comerciais

- Serviços Institucionais

- Sobre

Forex, also known as foreign exchange, FX or currency trading, is a decentralized global market where all the world's currencies trade. The forex market is the largest, most liquid market in the world with an average daily trading volume exceeding $5 trillion. All the world's combined stock markets don't even come close to this.

The largest stock market in the world, the New York Stock Exchange (NYSE), trades a volume of about $22.4 billion each day. That huge $5 trillion number covers the entire global foreign exchange market, BUT retail traders trade the spot market and that’s about $1.8 trillion.

The simple answer is MONEY.

Think of buying a currency as buying a share in a particular country, kinda like buying stocks of a company. The price of the currency is usually a direct reflection of the market’s opinion on the current and future health of its respective economy.

In forex trading, when you buy, say, the Japanese yen, you are basically buying a “share” in the Japanese economy. You are betting that the Japanese economy is doing well and will even get better as time goes. Once you sell those “shares” back to the market, hopefully, you will end up with a profit. In general, the exchange rate of a currency versus other currencies reflects the condition of that country’s economy, compared to other countries’ economies.

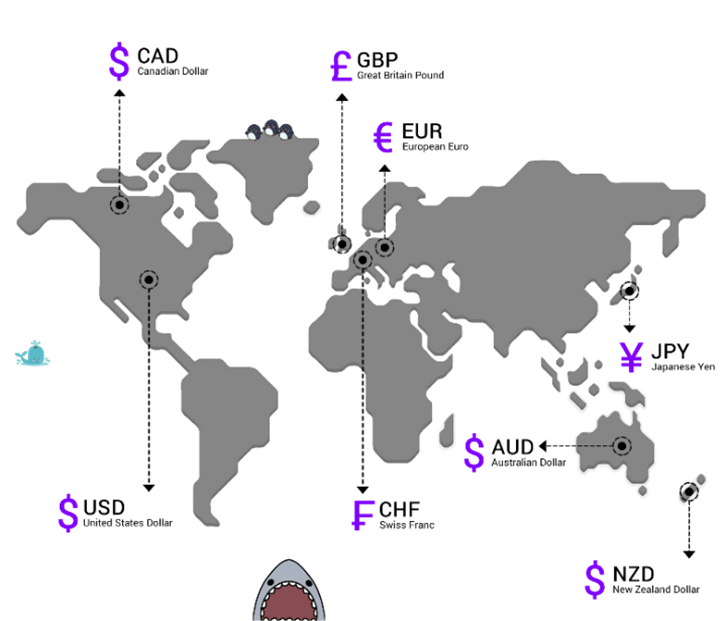

While there are potentially lots of currencies you can trade, as a new trader, you will probably start trading with the “major currencies.”

|

SYMBOL |

COUNTRY |

CURRENCY |

|

USD |

United States |

Dollar |

|

EUR |

Eurozone |

Euro |

|

JPY |

Japan |

Yen |

|

GBP |

Great Britain |

Pound |

|

CHF |

Switzerland |

Franc |

|

CAD |

Canada |

Dollar |

|

AUD |

Australia |

Dollar |

|

NZD |

New Zealand |

Dollar |

Currency symbols always have three letters, where the first two letters identify the name of the country and the third letter identifies the name of that country’s currency.

Take NZD for instance. NZ stands for New Zealand, while D stands for dollar. The currencies included in the chart above are called the “majors” because they are the most widely traded ones.

When we buy a currency pair, it means that we are buying the Base Currency by selling the Quote Currency. Buying EUR/USD means that we are buying euro by selling USD.

When we sell a currency pair, it means that we are selling the Base Currency by buying the Quote Currency. Selling EUR/USD means that we are selling the euros to buy USD.

The currency pairs listed below are considered the “majors.” These pairs all contain the U.S. dollar (USD) on one side and are the most frequently traded.

|

CURRENCY PAIR |

COUNTRIES |

FX GEEK SPEAK |

|

EUR/USD |

Eurozone / United States |

“euro dollar” |

|

USD/JPY |

United States / Japan |

“dollar yen” |

|

GBP/USD |

United Kingdom / United States |

“pound dollar” |

|

USD/CHF |

United States/ Switzerland |

“dollar swissy” |

|

USD/CAD |

United States / Canada |

“dollar loonie” |

|

AUD/USD |

Australia / United States |

“aussie dollar” |

|

NZD/USD |

New Zealand / United States |

“kiwi dollar” |

Currency pairs that don’t contain the U.S. dollar (USD) are known as cross-currency pairs or simply as the “crosses.” Major crosses are also known as “minors.” The most actively traded minors are derived from the three major currencies: EUR, JPY, and GBP.

|

CURRENCY PAIR |

COUNTRIES |

FX GEEK SPEAK |

|

EUR/CHF |

Eurozone / Switzerland |

“euro swissy” |

|

EUR/GBP |

Eurozone / United Kingdom |

“euro pound” |

|

EUR/CAD |

Eurozone / Canada |

“euro loonie” |

|

EUR/AUD |

Eurozone / Australia |

“euro aussie” |

|

EUR/NOK |

Eurozone / Norway |

“euro nockie” |

|

CURRENCY PAIR |

COUNTRIES |

FX GEEK SPEAK |

|

EUR/JPY |

Eurozone / Japan |

“euro yen” or “yuppy” |

|

GBP/JPY |

United Kingdom / Japan |

“pound yen” or “guppy” |

|

CHF/JPY |

Switzerland / Japan |

“swissy yen” |

|

CAD/JPY |

Canada / Japan |

“loonie yen” |

|

AUD/JPY |

Australia / Japan |

“aussie yen” |

|

NZD/JPY |

New Zealand / Japan |

“kiwi yen” |

|

CURRENCY PAIR |

COUNTRIES |

FXGEEK SPEAK |

|

GBP/CHF |

United Kingdom / Switzerland |

“pound swissy” |

|

GBP/AUD |

United Kingdom / Australia |

“pound aussie” |

|

GBP/CAD |

United Kingdom / Canada |

“pound loonie” |

|

GBP/NZD |

United Kingdom / New Zealand |

“pound kiwi” |

|

CURRENCY PAIR |

COUNTRIES |

FX GEEK SPEAK |

|

AUD/CHF |

Australia / Switzerland |

“aussie swissy” |

|

AUD/CAD |

Australia / Canada |

“aussie loonie” |

|

AUD/NZD |

Australia / New Zealand |

“aussie kiwi” |

|

CAD/CHF |

Canada / Switzerland |

“loonie swissy” |

|

NZD/CHF |

New Zealand / Switzerland |

“kiwi swissy” |

|

NZD/CAD |

New Zealand / Canada |

“kiwi loonie” |

Exotic currency pairs are made up of one major currency paired with the currency of an emerging economy, such as Brazil, Mexico or Hungary. The chart below contains a few examples of exotic currency pairs. These pairs aren’t as heavily traded as the “majors” or “crosses,” so the transaction costs associated with trading these pairs are usually bigger.

|

CURRENCY PAIR |

COUNTRIES |

FXGEEK SPEAK |

|

USD/HKD |

United States / Hong Kong |

|

|

USD/SGD |

United States / Singapore |

|

|

USD/ZAR |

United States / South Africa |

“dollar rand” |

|

USD/THB |

United States / Thailand |

“dollar baht” |

|

USD/MXN |

United States / Mexico |

“dollar mex” |

|

USD/DKK |

United States / Denmark |

“dollar krone” |

|

USD/SEK |

United States / Sweden |

“dollar stockie” |

|

USD/NOK |

United States / Norway |

“dollar nockie” |

It’s not unusual to see spreads that are two or three times bigger than that of EUR/USD or USD/JPY.

For trading newbies out there, you should know that commodity prices can affect currency price action. In fact, commodity-related currencies like the Aussie, Loonie, and Kiwi often take cues from commodity prices trends.

|

COMMODITY |

DESCRIPTION |

|

USCOCOA |

US COCOA |

|

SOYBEAN |

SOYBEAN |

|

BRENT |

BRENT OIL FUTURE |

|

COPPER |

COPPER FUTURE |

|

USOIL |

West Texas Intermediate Crude Oil Cash |

|

UKCOCOA |

UK COCOA |

A stock index or stock market index is a measurement of a section of the stock market. It is computed from the prices of selected stocks. It is a tool used by investors and financial managers to describe the market, and to compare the return on specific investments.

|

INDICES |

DESCRIPTION |

FX GEEK SPEAK |

|

DAX30 |

Deutscher Aktien Index |

“DAX” |

|

DJ30 |

Dow Jones Industrial Average |

“Dow” |

|

NASDAQ |

National Association of Securities Dealers Automated Quotations |

“NASDAQ” |

|

S&P500 |

Standard & Poor 500 |

“S&P500” |

|

Nikkei |

Average Index of the Japanese stock market |

“Nikkei” |

|

FTSE |

FTSE 100 or FTSE 250 depending on the number of companies included in the index |

“Footsie” |

If you trade cryptocurrencies, it’s not enough to pay attention to just BTC/USD (bitcoin).

By only trading bitcoin, you’re missing out on other potential trading opportunities.

You should also be monitoring other cryptocurrencies (also known as “altcoins”) as well.

|

CRYPTO PAIR |

DESCRIPTION |

|

BTC/USD |

Bitcoin vs US Dollar |

|

ETH/USD |

Etherium vs US Dollar |

|

LTC/USD |

Litecoin vs US Dollar |

|

NEO/USD |

Neo vs US Dollar |

|

DASH/USD |

Dash vs US Dollar |

|

XMRUSD |

Monero vs US Dollar |

*The information presented above is intended for informative and educational purposes, should not be considered as investment advice, or an offer or solicitation for a transaction in any financial instrument and thus should not be treated as such. Past performance is not a reliable indicator of future results.

Cairo Investment Expo 2021

Ultimate FinTech Awards 2022

European Fintech 2022

2023 Global Forex Awards

Cairo Investment Expo 2021

Ultimate FinTech Awards 2022

European Fintech 2022

2023 Global Forex Awards

Online Chat Chat with us

Email:supportsohomarkets.com

Direitos autorais © 2024 - Todos os direitos reservados.

A Soho Markets LLC é constituída em São Vicente e Granadinas como uma empresa de negócios internacionais com número de registro 1310 LLC 2021.

Aviso de Risco: Os CFDs são instrumentos complexos e apresentam um elevado risco de perda rápida de dinheiro devido à alavancagem. Você deve considerar se entende como funcionam os CFDs e se pode correr o alto risco de perder seu dinheiro. Por favor, leia a divulgação de riscos completa.

Restrições Regionais: SOHO MARKETS GLOBAL LIMITED não fornece serviços nos territórios dos Estados Unidos da América, Canadá, Israel, Japão, Coreia do Norte, Bélgica e países sancionados pela ONU/UE.

A Soho Markets Global Limited e a Soho Markets LLC não prestam serviços a clientes da UE. Os clientes da UE só podem ser atendidos pela Vstar & Soho Markets Ltd.

ACORDO DE CLIENTE (TERMOS E CONDIÇÕES) Política de Privacidade Divulgação de Risco