In the forex markets, or for that matter, even futures or stocks, divergence is often related to the price and the oscillator that is tracking the prices. Divergences can be spotted by use of oscillators only and among the many different oscillators, the MACD, Stochastics, RSI, Awesome Oscillator, CCI, Williams %R are some of the more commonly used oscillators.

An oscillator is used to track the overbought and oversold prices. Because most of the oscillators are based on price and the relative momentum or volume, oscillators are the best choice for understanding momentum in prices which signal how strong the prevailing trend is.

When prices reverse or retrace, the oscillator tends to follow the same pattern. Therefore, when prices are making higher highs or higher lows, the oscillator tends to mimic the same pattern. Conversely, when prices are making lower highs and lower lows, the oscillators tend to print the corresponding lower highs and lower lows. This is what we already knew as convergence. When price makes a high or a low and the oscillator fails to confirm the same, it is known as divergence. By spotting these divergences, traders are usually signaled to a potential change in the direction of prices.

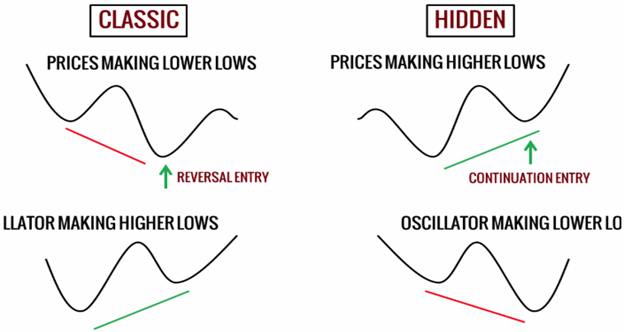

There are TWO types of divergence:

1. Classic

2. Hidden

Regular divergence is the classic sense of divergence that occurs when the price action makes higher highs or lower lows while the oscillating indicator does not. This indicates a weakness in the price action and a nearly warning that the trend could be coming to an end. In other words, regular divergence indicates that a probable trend reversal could occur through it does not indicated when this will occur. For this reason, chartists often turn to trend lines, chart patterns and candlestick patterns to time the entry into the trade.

Occurs in a down trend when the price action prints lower lows that are not confirmed by the oscillating indicator. This indicates a weakness in the down trend as selling is less urgent or buyers are emerging. When the oscillator fails to confirm the lower lows on the price action, it can either makes higher lows, which is more significant, or it can make double or triple bottoms. The latter occurs more often on oscillators, such as RSI and Stochastics that are range bound and less often on oscillators such as MACD that is not range bound.

Occurs in an uptrend when the price action makes higher highs that are not confirmed by the oscillating indicator. This indicates a weakness in the uptrend as buying is less intense and selling or profit taking is increasing. As with positive divergence, the oscillator can fail to confirm the higher highs on the price action by either making lower highs, which is more significant, or by making double or triple tops. As with positive divergence, double and triple tops are more prevalent on range bound oscillators.

Hidden divergence occurs when the oscillator makes a higher high of lower low while the price action does not. This often tends to occur during consolidation or corrections within an existing trend and usually indicates that there is still strength in the prevailing trend and that the trend will resume. In other words, hidden divergence is akin to a continuation pattern. As with regular divergence, hidden divergence can be bullish or bearish.

Occurs during a correction in an uptrend when the oscillator makes a higher high while the price action does not as it is in a correction or consolidation phase. This indicates that there is still strength in the uptrend and that the correction is merely profit taking rather than the emergence of strong selling and is thus unlikely to be last long. Thus, the uptrend can be expect to resume.

Occurs during a reaction in a down trend when the oscillator makes a lower low while the price action does not as it is in a reaction or consolidation phase. This indicates that the selling has not waned and that that down trend is still strong. The reaction is merely profit taking rather than the emergence of strong buyers and is thus likely to be short lived. As a result, the down trend is more likely to resume in due time.

There are different environments that a currency can trade in and being aware of that environment might help you make better trading decisions. A trading environment is the type of price action that has been occurring recently and will likely continue into the near future. For example, a currency could be ranging, where it is stuck between two points, or it could be trending, where it has a consistent movement in one direction.

Some trading strategies work better than others in certain trading environments, which is why it's important to be aware of it. For example, a spinning top indicator can signal a reversal, but the indicator works much better when the currency is trending. The trading environment can be classified into three scenarios: Trending up, Trading down and Ranging

A trending market is a market that is trending in a specific direction. Markets can have bullish, bearish or sideways trends. A trending market can provide multiple trading opportunities for technical analysts. Technical analysts will chart the price pattern of a security or market index to identify trending directions for placing investment trades. Investors may also follow the trending direction of an index that serves as a benchmark for a specific security. These trending market lines can serve as an overlay to a security price chart which can help to form an additional indicator for market trends.

Trending markets are of primary interest in technical analysis. Technical analysts believe that trending markets occur with some degree of regularity and predictability. The ability to correctly discern these trends can have a substantial impact on investment returns.

A way to determine if the market is trending is through the use of the Average Directional Index indicator or ADX for short. Take a look at this example. Price is clearly trending downwards even though ADX is greater than 25.

If you’re not a fan of the ADX, you can also make use of simple moving averages. Check this out!

Place a 7 period, a 20 period, and a 65 period Simple Moving Average on your chart. Then, wait until the three SMA’s compress together and begin to fan out. If the 7 period SMA fans out on top of the 20 period SMA, and the 20 SMA on top of the 65 SMA, then price is trending up.

On the other hand, if the 7 period SMA fans out below the 20 period SMA, and the 20 SMA is below the 65 SMA, then price is trending down.

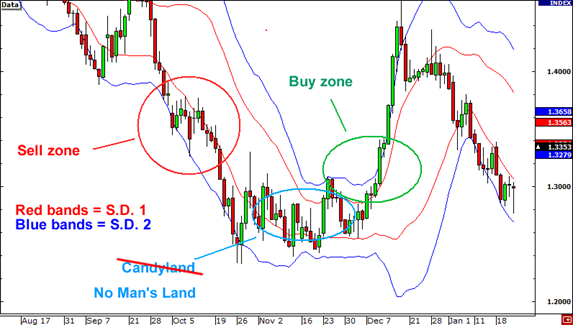

Bollinger bands actually contain the standard deviation formula.

Here’s how we can use Bollinger bands to determine the trend! Place Bollinger bands with a standard deviation of 1 and another set of bands with a standard deviation of 2. You will see three set of price zones: the sell zone, the buy zone, and the “No-man’s Land.”

The sell zone is the area between the two bottom bands of the standard deviation 1 (SD 1) and standard deviation 2 (SD 2) bands. Bear in mind that price has to close within the bands in order to be considered in the sell zone. The buy zone is the area between the two top bands of the SD 1 and SD 2 bands. Like the sell zone, price has to close within the two bands in order to be considered in the buy zone. The area in between the standard deviation 1 bands is an area in which the market struggles to find direction. Price will close within this area if price is really in “No-Man’s Land”. Price direction is pretty much up for grabs. The Bollinger bands make it easier to confirm a trend visually. Downtrends can be confirmed when price is in the sell zone. Uptrends can be confirmed when price is in the buy zone.

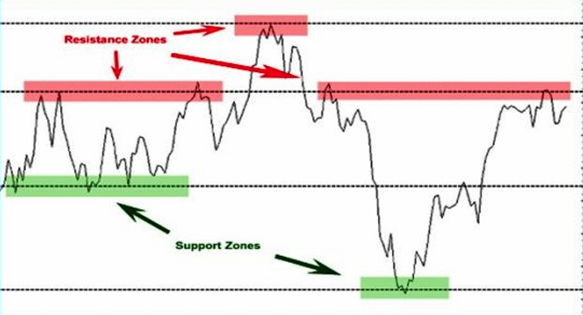

A range-bound market is observed as a trading strategy that identifies stocks trading in channels. By finding major support and resistance levels with technical analysis, a range-bound trader buys stocks at the lower level of support (bottom of the channel) and sells them near resistance (top of the channel). The present range-bound market represents the typical trading strategy characteristics, with the top of the trading range being called the resistance, because it is known as the price limit within the current trading range: and, the bottom level is called the support, which is the lowest price that a stock has recently traded at.

Resistance is the price level at which selling is thought to be strong enough to prevent the price from rising further. The logic dictates that as the price advances towards resistance, sellers become more inclined to sell, and buyers become less inclined to buy. By the time the price reaches the resistance level, it is believed that supply will overcome demand and prevent the price from rising above resistance.

Conversely, in a range-bound market, support is the price level at which demand is thought to be strong enough to prevent the price from declining further. The logic dictates that as the price declines towards support and gets cheaper, buyers become more inclined to buy, and sellers become less inclined to sell. By the time the price reaches the support level, it is believed that demand will overcome supply and prevent the price from falling below support. If a stock's price falls below current support, it may signal a declining trend to a lower trading range.

One way to determine if the market is ranging is to use the same ADX that we discussed earlier.

A market is said to be ranging when the ADX is below 25.

In essence, Bollinger bands contract when there is less volatility in the market and expand when there is more volatility. Because of that, Bollinger bands provide a good tool for breakout strategies. When the bands are thin and contracted, volatility is low and there should be little movement of price in one direction. However, when bands start to expand, volatility is increasing and more movement of price in one direction is likely.

Generally, range trading environments will contain somewhat narrow bands compared to wide bands and form horizontally. In this case, we can see that the Bollinger bands are contracted, as price is just moving within a tight range.

The basic idea of a range-bound strategy is that a currency pair has a high and low price that it normally trades between. By buying near the low price, the forex trader is hoping to take profit around the high price. By selling near the high price, the trader is hoping to take profit around the low price.

Popular tools to use are channels such as the one shown above and Bollinger bands. Using oscillators, like Stochastic or RSI, will help increase the odds of you finding a turning point in a range as they can identify potentially oversold and overbought conditions:

*The information presented above is intended for informative and educational purposes, should not be considered as investment advice, or an offer or solicitation for a transaction in any financial instrument and thus should not be treated as such. Past performance is not a reliable indicator of future results.

Cairo Investment Expo 2021

Ultimate FinTech Awards 2022

European Fintech 2022

2023 Global Forex Awards

Cairo Investment Expo 2021

Ultimate FinTech Awards 2022

European Fintech 2022

2023 Global Forex Awards

Online Chat Chat with us

Email:supportsohomarkets.com

저저작권 © 2024 - 모든 권리 보유.

Soho Markets LLC는 등록 번호 1310 LLC 2021로 세인트 빈센트 그레나딘에 국제 비즈니스 회사로 설립되었습니다.

위험 경고: CFD는 복잡한 상품이며 레버리지로 인해 빠르게 돈을 잃을 위험이 높습니다. CFD의 작동 방식을 이해하고 있는지, 돈을 잃을 위험을 감수할 여유가 있는지 고려해야 합니다. 전체 위험 공개를 읽어보시기 바랍니다.

지역 제한: SOHO MARKETS GLOBAL LIMITED는 미국, 캐나다, 이스라엘, 일본, 북한, 벨기에 및 UN/EU 제재 국가의 지역에서는 서비스를 제공하지 않습니다.

Soho Markets Global Limited 및 Soho Markets LLC는 EU 고객에게 서비스를 제공하지 않습니다. EU 고객은 Vstar & Soho Markets Ltd를 통해서만 서비스를 받을 수 있습니다.