The forex market is the biggest financial market in the world. Yet, it is one of the few financial markets that do not have a physical exchange or location. Forex trades emanate from the network of banks that act as the liquidity providers, and this aspect of the market is known as the interbank FX market.

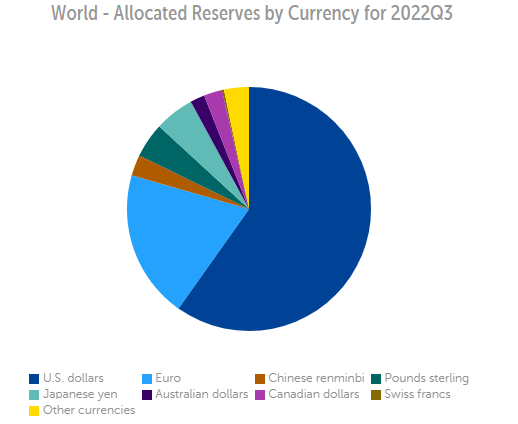

The mere fact that the FX market is borderless and is a virtual marketplace has contributed to make this market the largest in the world. This is because participants in the FX market from the trading side of things do not have to congregate in a physical location to be able to trade FX or to buy/sell currencies. A virtual location can therefore absorb millions of people from all over the world in real-time, connecting with the computers or hand-held devices using the internet. An individual can in a matter of minutes, transit from someone who knows next to nothing about FX and actually place the first trade in the market. This has been made possible because of the internet and the placement of the FX market as a virtual, internet-driven marketplace. The dollar is the most traded currency, according to the International Monetary fund, followed by euro and yen.

In fact, according to the International Monetary Fund (IMF), the U.S. dollar comprises roughly 64% of the world’s official foreign exchange reserves! Because almost every investor, business, and central bank own it, they pay attention to the U.S. dollar.

There are also other significant reasons why the U.S. dollar plays a central role in the forex market:

1. The United States economy is the LARGEST economy in the world.

2. The U.S. dollar is the reserve currency of the world.

3. The United States has the largest and most liquid financial markets in the world.

4. The United States has a stable political system.

5. The United States is one of the world’s military superpower.

“Speculation” in Foreign Exchange is an act of buying and selling the foreign currency under the conditions of uncertainty with a view to earning huge gains.

Often, the speculators buy the currency when it is weak and sells when it is strong. Also, if the spot rate of the currency is expected to increase in the future, then the speculator buys forward and sell “on the spot” the currency bought by him. On the contrary, if the speculator anticipates a fall in the exchange rate, then he “sells forward” at the current rate and buy the spot when the currency is needed for the delivery.

The speculation is said to have both the stabilizing and destabilizing impact on the exchange rate. Such as, if the speculator buys the currency when it is cheap and sells when it is dear, is said to have a stabilizing effect on the exchange rate. However, there is a controversy with respect to the stabilizing and destabilizing of exchange rate due to the speculative transactions.

Speculators can provide market liquidity and narrow the bid-ask spread, enabling producers to hedge price risk efficiently Speculative short-selling may also keep rampant bullishness in check and prevent the formation of asset price bubbles through betting against successful outcomes.

Mutual funds and hedge funds often engage in speculation in the foreign exchange markets as well as bond and stock markets.

A currency future, also known as an FX future or a foreign exchange future, is a futures contract to exchange one currency for another at a specified date in the future at a price (exchange rate) that is fixed on the purchase date; see Foreign exchange derivative. Typically, one of the currencies is the US dollar. The price of a future is then in terms of US dollars per unit of other currency. This can be different from the standard way of quoting in the spot foreign exchange markets. The trade unit of each contract is then a certain amount of other currency, for instance €125,000. Most contracts have physical delivery, so for those held at the end of the last trading day, actual payments are made in each currency. However, most contracts are closed out before that. Investors can close out the contract at any time prior to the contract's delivery date.

A currency option is a type of options contract that gives the holder the right, but not the obligation, to buy or sell a currency pair at a given price before a set time of expiry. To get this right, the holder of the option pays a premium to the seller (known as the option’s writer).

If a trader “sold” an option, then he or she would be obliged to buy or sell an asset at a specific price at the expiration date. However, the disadvantage in trading FX options is that market hours are limited for certain options and the liquidity is not nearly as great as the futures or spot market.

Currency ETFs (exchange-traded funds) are designed to track the performance of a single currency in the foreign exchange market against the US dollar or a basket of currencies. This is accomplished by multiple methods like cash deposits, short-term debt denominated in a currency, and future or swap contracts. In the past, these markets were only accessible to experienced traders but the rise of exchange-traded funds over the past decade has opened the foreign exchange market to all types of investors.

ETFs are created and managed by financial institutions who buy and hold currencies in a fund. They then offer shares of the fund to the public on an exchange allowing you to buy and trade these shares just like stocks. Like currency options, the limitation in trading currency ETFs is that the market isn’t open 24 hours. Also, ETFs are subject to trading commissions and other transaction costs.

In the spot market, currencies are traded immediately or “on the spot,” using the current market price. It’s very easy to participate in this market since accounts can be opened with lower funds!

Aside from that, most forex brokers usually provide charts, news, and research for free.

There are many benefits and advantages of trading forex.

1. No commissions: Most retail brokers are compensated for their services through something called the “bid/ask spread“.

2. No middlemen: Spot currency trading eliminates the middlemen and allows you to trade directly with the market responsible for the pricing on a particular currency pair.

3. No fixed lot sizes: In the futures markets, lot or contract sizes are determined by the exchanges. A standard size contract for silver futures is 5,000 ounces. In spot forex, you determine your own lot, or position size.

4. Low transaction costs: The retail transaction cost (the bid/ask spread) is typically less than 0.1% under normal market conditions. For larger transactions, the spread could be as low as 0.07%. Of course, this depends on your leverage.

5. A 24-hour market

6. No one can corner the market: The foreign exchange market is so huge and has so many participants that no single entity can control the market price for an extended period of time.

7. Leverage: In forex trading, a small deposit can control a much larger total contract value. Leverage gives the trader the ability to make nice profits but can also lead to large losses as well. For example, a forex broker may offer 50-to-1 leverage, which means that a $50 dollar margin deposit would enable a trader to buy or sell $2,500 worth of currencies. Similarly, with $500 dollars, one could trade with $25,000 dollars and so on.

8. High Liquidity: Because the forex market is so enormous, it is also extremely liquid. This is an advantage because it means that under normal market conditions, with a click of a mouse you can instantaneously buy and sell at will as there will usually be someone in the market willing to take the other side of your trade. You can even set your online trading platform to automatically close your position once your desired profit level (a limit order) has been reached, and/or close a trade if a trade is going against you (a stop loss order).

9. Low Barriers to Entry: You would think that getting started as a currency trader would cost a ton of money. The fact is, when compared to trading stocks, options or futures, it doesn’t. Online forex brokers offer “mini” and “micro” trading accounts, some with a minimum account deposit of $25.

10. Demo Accounts: Most online forex brokers offer “demo” accounts to practice trading and build your skills, along with real-time forex news and charting services. Demo accounts are very valuable resources for those who are “financially hampered” and would like to hone their trading skills with “play money” before opening a live trading account and risking real money.

For the sake of comparison, let’s first examine the stock market.

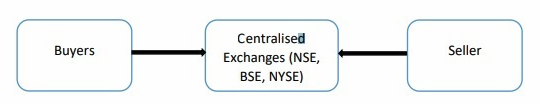

This is how the structure of the stock market looks like:

By its very nature, the stock market tends to be very monopolistic. There is only one entity, one specialist that controls prices. In the stock market, the Stock Exchanges (SE) are forced to fulfill the order of their clients. Now, let’s say the number of sellers suddenly exceed the number of buyers.

The SE, which is forced to fulfill the order of its clients, the sellers in this case, is left with a bunch of stock that he cannot sell-off to the buyer side. In order to prevent this from happening, the specialist will simply widen the spread or increase the transaction cost to prevent sellers from entering the market.

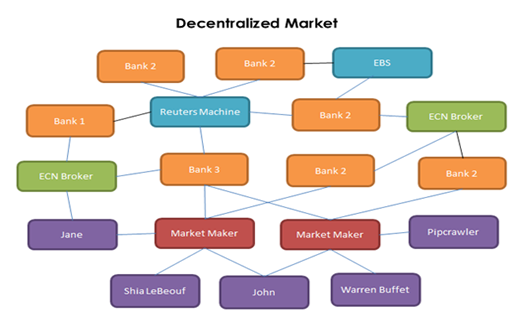

A decentralized market is a market structure that consists of a network of various technical devices that enable investors to create a marketplace without a centralized location. In a decentralized market, technology provides investors with access to various bid/ask prices and makes it possible for them to deal directly with other investors/dealers rather than with a given exchange.

The foreign exchange market is an example of a decentralized market because there is no one physical location where investors go to buy or sell currencies. Forex traders can use the internet to check the quotes of various currency pairs from different dealers from around the world.

In a basic sense, a decentralized market is where a variety of assets are bought, sold, or traded. Real estate, for example, is traditionally sold through a decentralized market, wherein buyers and sellers complete their transactions without first funneling the process through some sort of clearing house. Bonds and securitized products can also be procured through decentralized markets.

The advent and rise of blockchain technology and cryptocurrency have created more opportunities for decentralized markets to operate. Through such technology and mediums, buyers and sellers are afforded a sense of security and trust in transactions without the need for a central clearinghouse to monitor and affirm the transactions.

The participants in the FX market can be organized into a ladder:

At the very top of the forex market ladder is the interbank market. Composed of the largest banks in the world and some smaller banks, the participants of this market trade directly with each other or electronically. Next on the ladder are the hedge funds, corporations, retail market makers, and retail ECNs. Since these institutions do not have tight credit relationships with the participants of the interbank market, they have to do their transactions via commercial banks. This means that their rates are slightly higher and more expensive than those who are part of the interbank market.

*The information presented above is intended for informative and educational purposes, should not be considered as investment advice, or an offer or solicitation for a transaction in any financial instrument and thus should not be treated as such. Past performance is not a reliable indicator of future results.

Cairo Investment Expo 2021

Ultimate FinTech Awards 2022

European Fintech 2022

2023 Global Forex Awards

Cairo Investment Expo 2021

Ultimate FinTech Awards 2022

European Fintech 2022

2023 Global Forex Awards

Online Chat Chat with us

Email:supportsohomarkets.com

저저작권 © 2024 - 모든 권리 보유.

Soho Markets LLC는 등록 번호 1310 LLC 2021로 세인트 빈센트 그레나딘에 국제 비즈니스 회사로 설립되었습니다.

위험 경고: CFD는 복잡한 상품이며 레버리지로 인해 빠르게 돈을 잃을 위험이 높습니다. CFD의 작동 방식을 이해하고 있는지, 돈을 잃을 위험을 감수할 여유가 있는지 고려해야 합니다. 전체 위험 공개를 읽어보시기 바랍니다.

지역 제한: SOHO MARKETS GLOBAL LIMITED는 미국, 캐나다, 이스라엘, 일본, 북한, 벨기에 및 UN/EU 제재 국가의 지역에서는 서비스를 제공하지 않습니다.

Soho Markets Global Limited 및 Soho Markets LLC는 EU 고객에게 서비스를 제공하지 않습니다. EU 고객은 Vstar & Soho Markets Ltd를 통해서만 서비스를 받을 수 있습니다.