The market order is probably the most basic and often the first FX order type traders come across. Just as the name implies, market orders are traded at market. This means if you want to get into the forex market immediately, you can trade a market order and be entered at the prevailing price.

Typically, scalpers and day traders rely on market orders to enter and exit the market quickly, in accordance to their strategy.

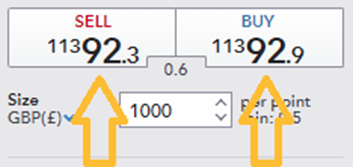

The EUR/USD deal ticket below shows live prices to buy and sell. A market order to buy at 11392.9 would execute immediately at the current price. The same will apply to a short position.

There are two types of limit orders involved in forex trading:

The first is a limit entry order to get a better entry price. If the EUR/USD is trading at 1.1294 and you thought it would trade down to 1.1200 before rallying, you would place your limit order to buy at 1.1200. If the EUR/USD is trading at the 1.12939 level and you thought it would rally up to 1.1300 before selling off, you would place your limit order to sell 1.1300. When using a limit order, you will only be filled at the price you designated or better.

You can also use a limit order to close a trade when the market moves a specified amount in your favor. If you bought the EUR/USD at 1.1300 and wanted to exit when your trade showed a profit of 100 pips, you would place your sell limit order 100 pips above your entry or at the 1.1400 level. If you sold the EUR/USD at 1.1300 and wanted to exit when your trade showed a profit of 100 pips, you would place your buy limit order 100 pips below your entry or at the 1.1200 level.

Stop orders are also frequently used in forex trading, and there are two variations:

The first is a stop order to enter into the market. These orders can be used for trading breakouts. If you thought the EUR/USD would rally further after a move above the 1.1500 level, you would place a buy stop for entry at 1.1501. As the market printed 1.1501, your buy stop would become a market order and be filled at the next best price available.

If you thought that the EUR/USD would continue moving down if it traded down through the 1.1200 level, you would place your sell stop for entry at the 1.1199 level. As the market printed 1.1199, your sell stop would become a market order and be filled at the next best price available.

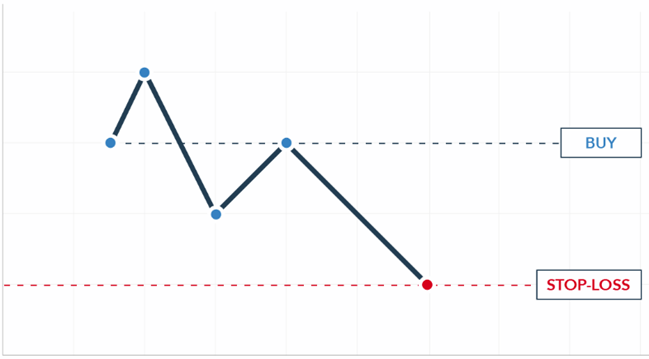

You can also use a protective stop order to close a trade when the market moves a specified amount against your position. If you bought the EUR/USD at 1.1500 and wanted to limit your risk to 50 pips, you would place your protective sell stop 50 pips below your entry or at the 1.1450 level.

If you sold the EUR/USD at 1.1400 and wanted to limit your risk to 50 pips, you would place your protective buy stop 50 pips above your entry or at the 1.1450 level.

A stop-loss order is an order placed with a broker to sell a security when it reaches a certain price. Stop-loss orders are designed to limit an investor’s loss on a position in a security. Although most investors associate a stop-loss order with a long position, it can also protect a short position, in which case the security gets bought if it trades above a defined price.

If you are in a long position, it is a sell STOP order.

If you are in a short position, it is a buy STOP order.

A stop loss order remains in effect until the position is liquidated or you cancel the stop loss order.

If you own shares of ABC Inc., which is currently trading at $50, and want to hedge against a significant decline, you could enter a stop-loss order to sell your ABC holdings at $48. This type of stop-loss order is also called a sell-stop order. If ABC trades below $48, your stop-loss order is triggered and converts into a market order to sell ABC at the next available price. If the next price if $47.90, your ABC shares sell at $47.90.

Stop losses are extremely useful if you don’t want to sit in front of your monitor all day worried that you will lose all your money.

A trailing stop is a stop order that can be set at a defined percentage or dollar amount away from a security's current market price. For a long position, place a trailing stop loss below the current market price. For a short position, place the trailing stop above the current market price. A trailing stop is designed to protect gains by enabling a trade to remain open and continue to profit as long as the price is moving in the investor’s favor. The order closes the trade if the price changes direction by a specified percentage or dollar amount.

A trailing stop is typically placed at the same time the initial trade is placed, although it may be placed after as well.

Assume you bought Alphabet Inc. (GOOG) at $1,000. By looking at prior advances in the stock you see that the price will often pullback 5% to 8% before moving higher again. These prior movements can help establish the percentage level to use for a trailing stop.

Choosing 3%, or even 5%, may be too tight. Even minor pullbacks tend to move more than this, which means the trade is likely to be stopped out by the trailing stop before the price has a chance to move higher.

Choosing a 20% trailing stop is excessive. Based on the recent trends, the average pullback is about 6%, with bigger ones near 8%.

A better trailing stop loss would be 10% to 12%. This gives the trade room to move, yet also gets the trader out quickly if the price drops by more than 12%. A 10% to 12% drop is larger than a typical pullback which means something more significant could be going on—mainly, this could be a trend reversal instead of just a pullback.

Using a 10% trailing stop, your broker will execute a sell order if the price drops 10% below your purchase price. This is $900. If the price never moves above $1,000 after you buy, your stop loss will stay at $900. If the price reaches $1,010, your stop loss will move up to $909, which is 10% below $1,010. If the stock moves up to $1250, your broker will execute an order to sell if the price falls to $1,125. If the price starts falling from $1,250 and doesn't go back up, your trailing stop order stays at $1,125 and if the price drops to that price the broker will enter a sell order on your behalf.

The ideal trailing stop loss will change over time. During more volatile periods, a wider trailing stop is a better bet. During quieter times, or in a very stable stock, a tighter trailing stop loss may be effective. That said, once a trailing stop loss is set for an individual trade it should be kept as is. A common trading mistake is to increase risk once in a trade in order to avoid losses. It's called loss aversion, and it can cripple a trading account quickly.

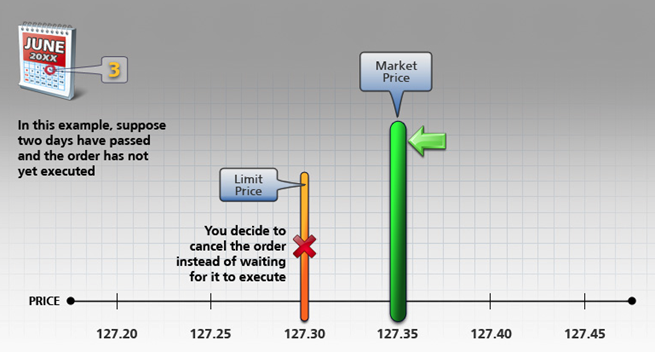

A Good-Til-Cancelled (GTC) order is an order to buy or sell a stock that lasts until the order is completed or cancelled. Brokerage firms typically limit the length of time an investor can leave a GTC order open. This time frame may vary from broker to broker. Investors should contact their brokerage firms to determine what time limit would apply to GTC orders.

An order with a good-til-canceled (GTC) time in force keeps the order working until it executes or you cancel it. In this example, it is Monday, June 1 and you want to buy 100 shares of XYZ, which is currently at 127.38 and you want the order to keep working until it fills. You create a limit order for 100 shares with a Limit Price of 127.30 and select GTC as the Time in Force. You've transmitted your limit order, which will work as a live order until it fills or until you cancel it. Two days have passed. Shares of XYZ have fallen to 127.35 but not to your limit price of 127.30; your order for 100 shares of XYZ has not been filled. At this point, you decide that you no longer want to wait for the market price of XYZ to fall to your limit price, so you cancel the order instead of waiting for it to execute.

The meaning of GFD is (Good for Day). So as a name suggest this type of order is only valid for a that day when you entered the order. If the order value don’t matched during that day then its automatically cancelled by the system. Let’s understand this with an a example. Suppose that you want to buy a ICICI bank stock at the price of ₹318.7 & the current market price of that stock is ₹320.

After entering the price in price section if you choose GFD in order validity drop-down then your order will only valid for the that particular day. If your order is not executed (If the price of the ICICI Stock is not reached to 318.7 form 320) on that particular day then the order you entered is automatically cancelled by the system. In simple words if you choose GFD then system will not carry forward your order for next day. If your order executed than its fine otherwise it will automatically cancelled by system.

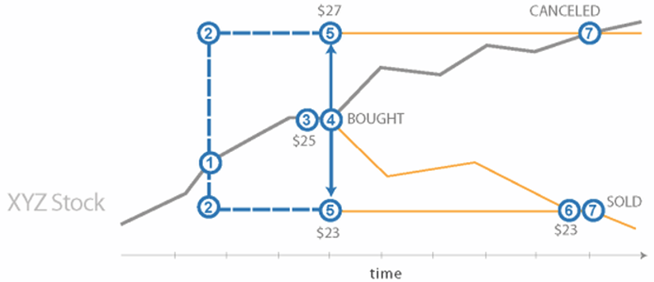

In trading, a one-cancels-the-other order is an instruction given when placing two orders simultaneously. If one part of an order on a security is executed, then the other part is canceled. Such an order is also referred to as an "alternative order" or "either-or" order.

OCO orders are often used in online trading as a way to link a stop loss order (used to cut a loss) with a limit order (used to capture a gain). Once a stock hits a stop loss price target, there is no need for the other order to take profit on the same stock, or vice versa.

For example, an investor owns shares of company XYZ, currently trading for $25 per share. He believes the shares are undervalued, and expects the price to climb another $20. To make sure he locks in the gain, the investor places a sell limit order for $45, the maximum price at which he wishes to hold the stock. He also places a trailing stop order for $10, which will sell the shares if it drops $10 from its current high. As the prices climb to $45, the investor's sell limit order is triggered, selling his shares, and cancelling his trailing stop.

One-Triggers-the-Other (OTO) orders are one of several types of contingent orders, which consist of a primary and one or more secondary orders. When an OTO order is place, the primary order is active, while the secondary order is inactive. If the primary order executes, the secondary order automatically becomes active.

Typically, investors will use OTO orders to pair together buy and sell instructions. As is the case with other types of orders, OTOs can be coupled with Time-in-Force instructions which specify the duration of the order. If used with Time-in-Force instructions, when the primary order expires then so does the secondary order. Also, if the trader decides to cancel their primary order, the secondary order is automatically cancelled too.

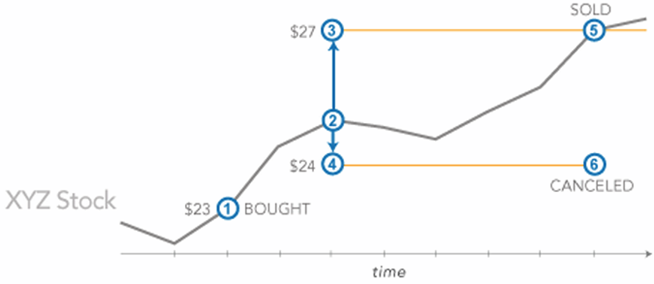

For example, an investor owns 500 shares of Company XYZ, which is currently selling at $20.00 per share. Recent economic news has increased the volatility of the stock market, including the price per share for Company XYZ. In order to mitigate this risk, the investor places an OCO order, which consists of a limit order to sell the 500 shares of Company XYZ at $24.00, and a stop-loss order to sell the same shares at $16.00. The investor also combines the order with Time-in-Force instructions that specify the OCO is Good-Til-Canceled.

*The information presented above is intended for informative and educational purposes, should not be considered as investment advice, or an offer or solicitation for a transaction in any financial instrument and thus should not be treated as such. Past performance is not a reliable indicator of future results.

Cairo Investment Expo 2021

Ultimate FinTech Awards 2022

European Fintech 2022

2023 Global Forex Awards

Cairo Investment Expo 2021

Ultimate FinTech Awards 2022

European Fintech 2022

2023 Global Forex Awards

Online Chat Chat with us

Email:supportsohomarkets.com

저저작권 © 2024 - 모든 권리 보유.

Soho Markets LLC는 등록 번호 1310 LLC 2021로 세인트 빈센트 그레나딘에 국제 비즈니스 회사로 설립되었습니다.

위험 경고: CFD는 복잡한 상품이며 레버리지로 인해 빠르게 돈을 잃을 위험이 높습니다. CFD의 작동 방식을 이해하고 있는지, 돈을 잃을 위험을 감수할 여유가 있는지 고려해야 합니다. 전체 위험 공개를 읽어보시기 바랍니다.

지역 제한: SOHO MARKETS GLOBAL LIMITED는 미국, 캐나다, 이스라엘, 일본, 북한, 벨기에 및 UN/EU 제재 국가의 지역에서는 서비스를 제공하지 않습니다.

Soho Markets Global Limited 및 Soho Markets LLC는 EU 고객에게 서비스를 제공하지 않습니다. EU 고객은 Vstar & Soho Markets Ltd를 통해서만 서비스를 받을 수 있습니다.