Bagian dari Grup V&S

-

Jual beli

Platform Perdagangan

Jenis akun

Persyaratan Margin

- Sumber Daya Perdagangan

- Layanan Kelembagaan

- Tentang

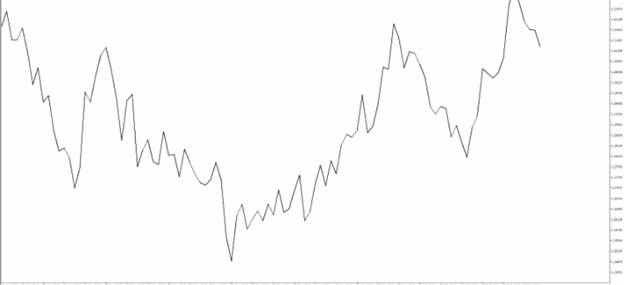

A line chart connects the closing prices of the timeframe you are viewing. So, when viewing a daily chart the line connects the closing price of each trading day. This is the most basic type of chart used by traders. It is mainly used to identify bigger picture trends but does not offer much else unlike some of the other chart types:

An OHLC bar chart shows a bar for each time period the trader is viewing. So, when looking at a daily chart, each vertical bar represents one day's worth of trading. The bar chart is unique as it offers much more than the line chart such as the open, high, low and close (OHLC) values of the bar.

The dash on the left represents the opening price and the dash on the right represents the closing price. The high of the bar is the highest price the market traded during the time period selected. The low of the bar is the lowest price the market traded during the time period selected.

2. The red bars are known as seller bars as the closing price is below the opening price.

In either case, the OHLC bar charts help traders identify who is in control of the market - buyers or sellers. These bars form the basis of the next chart type called candlestick charts which is the most popular type of forex charting:

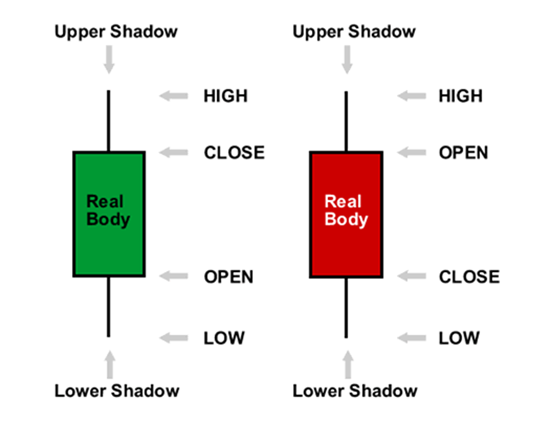

Candlestick charts were first used by Japanese rice traders in the 18th century. They are similar to OHLC bars in the fact they also give the open, high, low and close values of a specific time period. However, candlestick charts have a box between the open and close price values. This is also known as the 'body' of the candlestick.

Many traders find candlestick charts the most visually appealing when viewing live forex charts. They are also very popular as they provide a variety of price action patterns used by traders all over the world.

1. Candlesticks are easy to interpret, and are a good place for beginners to start figuring out forex chart analysis.

2. Candlesticks are easy to use! Your eyes adapt almost immediately to the information in the bar notation.

3. Candlesticks are good at identifying market turning points – reversals from an uptrend to a downtrend or a downtrend to an uptrend.

*The information presented above is intended for informative and educational purposes, should not be considered as investment advice, or an offer or solicitation for a transaction in any financial instrument and thus should not be treated as such. Past performance is not a reliable indicator of future results.

Cairo Investment Expo 2021

Ultimate FinTech Awards 2022

European Fintech 2022

2023 Global Forex Awards

Cairo Investment Expo 2021

Ultimate FinTech Awards 2022

European Fintech 2022

2023 Global Forex Awards

Online Chat Chat with us

Email:supportsohomarkets.com

Hak Cipta © 2024 - Semua hak dilindungi undang-undang.

Soho Markets LLC didirikan di St. Vincent & Grenadines sebagai Perusahaan Bisnis Internasional dengan nomor registrasi 1310 LLC 2021.

Peringatan Risiko: CFD adalah instrumen yang kompleks dan memiliki risiko tinggi kehilangan uang dengan cepat akibat leverage. Anda harus mempertimbangkan apakah Anda memahami cara kerja CFD dan apakah Anda mampu mengambil risiko tinggi kehilangan uang Anda. Silakan baca Pengungkapan Risiko selengkapnya.

Pembatasan Regional: SOHO MARKETS GLOBAL LIMITED tidak menyediakan layanan di wilayah Amerika Serikat, Kanada, Israel, Jepang, Korea Utara, Belgia, dan negara-negara yang terkena sanksi PBB/UE.

Soho Markets Global Limited dan Soho Markets LLC tidak menyediakan layanan kepada klien UE. Klien UE hanya dapat dilayani oleh Vstar & Soho Markets Ltd

PERJANJIAN KLIEN (SYARAT DAN KETENTUAN) Kebijakan pribadi Pengungkapan Risiko